The Hidden Cost of Ignoring Building Technology in Acquisitions

In most real estate acquisitions, the checklist is familiar.

Roof.

HVAC.

Structure.

CapEx reserves.

For asset managers, this often means inheriting decisions you didn’t make, systems you didn’t select, and contracts you didn’t negotiate, while still being accountable for performance, budgets, and long-term outcomes.

There’s one category that rarely gets the same level of scrutiny yet has a habit of surfacing later in expensive ways: Building technology exposure.

We see it consistently. A deal closes cleanly. Operations begin. Then, months into ownership, technology issues emerge, end-of-life systems, restrictive contracts, unsupported hardware, or infrastructure that can’t support the business plan.

None of it was obvious in the model.

What “Technology Exposure” Really Means

Technology exposure isn’t about whether a property has “good WiFi” or “smart systems.” It’s about understanding:

- What technology is installed today?

- Who owns and supports it?

- How flexible is it over time?

- When are refreshes or replacements coming?

- And what do those changes cost (financially and operationally)?

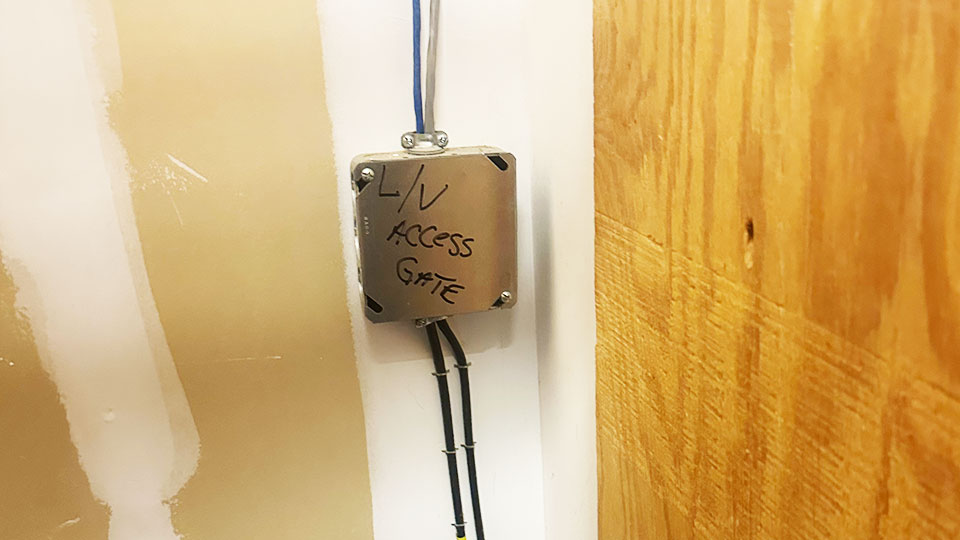

That includes networks, access control, CCTV, structured cabling, ISP agreements, IoT systems, and the vendor contracts tied to them.

Unlike physical systems, technology ages quietly… until it doesn’t.

The Surprises That Show Up After Close

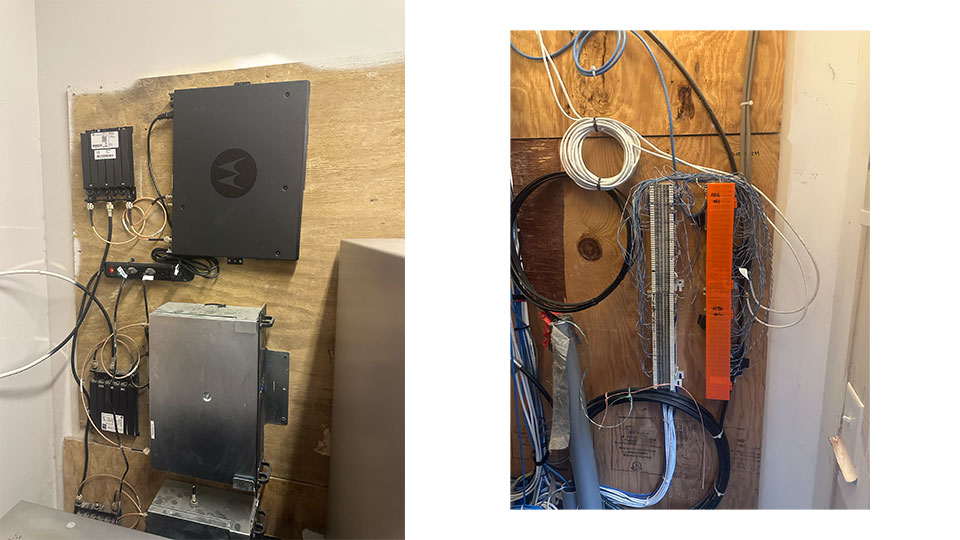

During building technology assessments, we regularly uncover issues that weren’t identified during traditional diligence, including:

- Network equipment that is already end-of-life or unsupported

- Long-term managed service agreements that don’t transfer cleanly with ownership

- Proprietary platforms that limit future vendor optionality

- Infrastructure that can’t support planned renovations, density increases, or amenity upgrades

- “Temporary” substitutions made during supply chain disruptions that became permanent

None of these issues are obvious during a walkthrough. All of them carry real financial and operational consequences.

Why Sellers Rarely Commission Technology Assessments

We’re often asked why sellers don’t proactively assess technology before listing an asset. The answer is simple: technology assessments surface risk.

Unlike cosmetic upgrades, technology findings don’t improve a marketing package. They raise questions, introduce uncertainty, and can complicate negotiations. As a result, sellers tend to avoid them.

Buyers, on the other hand, are the ones left to absorb the impact post-close.

Contracts: The Silent Risk Multiplier

Contractual exposure is one of the most common blind spots we see.

Internet service, access control, and surveillance systems are frequently tied to long-term agreements with specific vendors or platforms. Language like “Vendor X or equivalent” can appear flexible, but in practice it often isn’t. Not all vendors support the same hardware, and not all transitions are straightforward.

When a provider underperforms, exits the market, or no longer aligns with ownership strategy, asset managers can find themselves constrained by infrastructure decisions made years earlier.

Technology Life Cycles Don’t Match Hold Periods

Unlike roofs or chillers, technology doesn’t fail gracefully.

It’s often binary:

- Supported → unsupported

- Secure → vulnerable

- Functional → obsolete

And refresh cycles don’t always align with investment timelines. A system installed five years ago may already be approaching replacement – not because it’s broken, but because it no longer meets operational or security standards.

Understanding when those cliffs are coming matters just as much as knowing that they exist.

For asset managers, this creates real tension:

- Unplanned CapEx impacting year-one NOI

- Deferred upgrades that stall operational improvements

- Technology constraints that limit repositioning or refinancing

- Systems that complicate exit timing or buyer perception

Why This Matters to Asset Managers

Technology risk rarely shows up during diligence, but it shows up after close, when budgets are set, teams are in place, and asset managers are already accountable.

The goal isn’t to chase the latest technology or over-engineer solutions. It’s to understand what you own, what it will cost to maintain or refresh, and how much flexibility you truly have over the hold period.

Where WhiteSpace Comes In

WhiteSpace’s building technology assessments are designed specifically for asset managers and owners who want decision clarity. We evaluate existing systems, contracts, and lifecycle timing to surface technology exposure early, so CapEx can be planned intentionally, NOI can be protected, and there are no surprises after the deal is done.

Recent blogs

The Hidden Cost of Ignoring Building Technology in Acquisitions

In most real estate acquisitions, the checklist is familiar. Roof. HVAC. Structure. CapEx reserves. For asset managers, this often means inheriting decisions you didn’t make, systems you didn’t select, and contracts you didn’t negotiate, while still being accountable for performance, budgets, and long-term outcomes. There’s one category that rarely gets the same level of scrutiny yet has a habit of […]

4 Trends Reshaping Electronic Security (and Why They Matter to Owners)

The electronic security landscape is evolving fast, and if you haven’t looked closely in a while, you might be surprised by what’s changed. From cloud-based systems to smarter cameras, the next generation of access control and surveillance technology isn’t just more powerful – it’s more connected, efficient, and operationally intelligent. […]